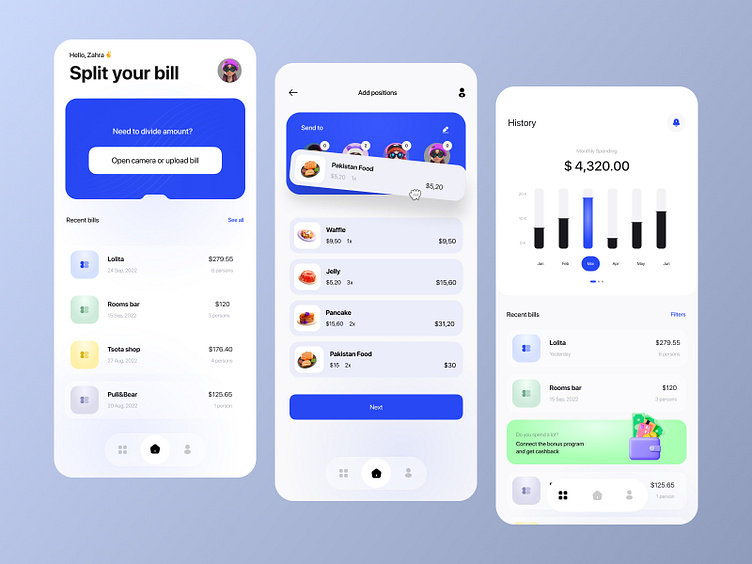

Payment & money management mobile application ui

Hello, FinTech Enthusiasts📱💳

I'm thrilled to share my latest project: a UI/UX design for a mobile payment assistant that simplifies how users manage their transactions. This design focuses on security and user convenience, incorporating features like voice recognition, real-time spending analytics, and personalized financial advice. The app provides a seamless interface for users to make payments, track expenses, and receive insights on their financial health, all powered by AI technology. 🚀🔒

Hope you find it as intriguing as I do!

Let's make magic happen together! 🌈

Thinking of bringing your own vision to life?

💬 Let's discuss!

I'm online in Telegram and discord to discuss about your project:

A Money Management App is a mobile platform designed to help users track their income, expenses, and savings while offering tools to budget, plan, and achieve financial goals. Whether targeting individuals, families, or small businesses, a well-designed money management app simplifies personal finance, fosters financial literacy, and encourages better financial habits. Here's a comprehensive guide to building a money management app with essential features, technologies, and monetization strategies.

Key Features of a Money Management App:

1. User Registration and Profiles

Sign-Up/Login: Allow users to register using email, phone, or social media accounts.

Personalized Profiles:

Add fields for income sources, spending habits, financial goals, and currency preferences.

Family or Joint Accounts: Allow users to create shared accounts for families or couples to manage finances together.

2. Expense Tracking

Manual Entry: Allow users to add expenses manually with categories like food, utilities, entertainment, and transportation.

Automated Expense Tracking:

Integrate with bank accounts and credit cards to automatically track transactions.

Use AI to categorize expenses (e.g., groceries, dining out, subscriptions).

Recurring Expenses: Identify recurring payments like rent, loans, or subscriptions.

3. Income Management

Multiple Income Sources:

Support salary, freelance work, investments, and other income streams.

Scheduled Income: Allow users to record expected income to anticipate cash flow.

4. Budgeting Tools

Custom Budgets:

Enable users to create budgets for categories like groceries, dining, and entertainment.

Real-Time Updates: Show how much of the budget remains in each category.

Budget Suggestions:

Use AI to suggest spending limits based on income and historical spending patterns.

Alerts and Notifications:

Notify users when they exceed budgets or approach their spending limits.

5. Savings and Goal Setting

Savings Goals:

Let users set specific goals (e.g., vacation, emergency fund, debt repayment).

Track progress with visual indicators like graphs or milestones.

Automated Savings:

Recommend savings amounts based on income and spending habits.

Integrate with bank APIs to schedule automatic transfers to savings accounts.

Gamification:

Add badges, streaks, or rewards for achieving financial goals.

6. Bill Management

Bill Reminders:

Notify users of upcoming due dates for credit cards, utilities, or loans.

Bill Tracking:

Provide a centralized dashboard for users to view all pending and paid bills.

Late Fee Alerts: Warn users about potential late fees if bills aren't paid on time.

7. Financial Insights and Analytics

Spending Breakdown:

Visualize spending habits with pie charts, graphs, and category overviews.

Cash Flow Analysis:

Show monthly inflow vs. outflow trends.

Customized Reports:

Generate detailed reports on specific categories, months, or custom date ranges.

Net Worth Tracker:

Allow users to calculate and track their net worth by including assets (e.g., savings, investments) and liabilities (e.g., loans, mortgages).

8. Investment Tracking

Portfolio Management:

Track stocks, mutual funds, crypto, or other investments.

Profit/Loss Analysis:

Show returns on investments and provide insights into portfolio performance.

Educational Content:

Offer articles, tutorials, or tips on investments, stocks, and financial planning.

9. Multi-Currency Support

Currency Conversion:

Support multiple currencies for international users or frequent travelers.

Cross-Border Expense Tracking:

Automatically categorize and convert expenses made in foreign currencies.

10. Security Features

Data Encryption:

Protect user data with end-to-end encryption.

Biometric Authentication:

Support fingerprint or face recognition for secure access.

Two-Factor Authentication (2FA):

Add an extra layer of security for account logins and sensitive actions.

11. Integration with Financial Services

Bank Syncing:

Use APIs like Plaid or FinBox to connect bank accounts and credit cards for real-time transaction tracking.

Tax Preparation:

Allow users to categorize expenses for tax purposes and export data to tax software.

Bill Payment Integration:

Integrate with utility companies, credit cards, and loan providers for direct payments.

12. Mobile Responsiveness and Offline Mode

Offline Access:

Allow users to log expenses and view past data without an internet connection.

Cross-Device Syncing:

Ensure seamless syncing across multiple devices using cloud-based storage.

13. Notifications and Alerts

Spending Alerts: Notify users when unusual spending patterns occur.

Low Balance Alerts: Warn users when their account balance drops below a specified amount.

Custom Reminders: Let users set reminders for financial tasks like checking budgets or transferring savings.

Technology Stack for a Money Management App:

Frontend:

iOS: Swift, Objective-C

Android: Kotlin, Java

Cross-Platform: Flutter, React Native

Backend:

Programming Languages: Node.js, Python (Django/Flask), Ruby on Rails

Database: MongoDB, PostgreSQL, MySQL

Cloud Infrastructure:

Hosting: AWS, Google Cloud, Microsoft Azure

APIs and Tools:

Financial Data Integration: Plaid, Yodlee, FinBox

Payment Gateway: Stripe, PayPal

Notifications: Firebase, OneSignal

Analytics: Mixpanel, Google Analytics

Monetization Strategies:

Freemium Model:

Offer basic features for free while charging for advanced tools like investment tracking or premium reports.

Subscription Plans:

Monthly or yearly subscriptions for ad-free experiences, advanced analytics, or exclusive content.

Advertisements:

Partner with financial institutions, credit cards, or loan providers to display relevant ads.

In-App Purchases:

Sell financial templates, premium features, or additional storage for transaction history.

Affiliate Partnerships:

Recommend credit cards, loans, or investment platforms and earn commissions for sign-ups.

Best Practices for Developing a Money Management App:

Simplify User Experience:

Make navigation intuitive with clear dashboards and step-by-step tutorials for new users.

Ensure Data Privacy:

Be transparent about data usage and comply with regulations like GDPR and CCPA.

Focus on Personalization:

Use AI to provide tailored financial tips, budget suggestions, and insights.

Scalability:

Build a scalable backend to handle growth in users and integrations with financial services.

Customer Support:

Offer in-app support with FAQs, chatbots, or live agent assistance for resolving issues.

Example Use Case Scenarios:

Personal Finance Management:

Track income, expenses, and budgets while setting savings goals.

Family Budgeting:

Share a single account with multiple profiles for managing family expenses.

Small Business Owners:

Categorize business expenses, track invoices, and prepare financial reports for taxes.

Frequent Travelers:

Manage expenses in multiple currencies and analyze travel-related costs.

Conclusion:

A money management app is an essential tool for users looking to take control of their financial health. By integrating features like budgeting tools, real-time expense tracking, savings goals, and investment insights, your app can deliver exceptional value. Prioritizing user security, personalization, and a seamless experience ensures long-term success in this competitive niche. With the right monetization strategy and thoughtful design, a money management app can become a go-to solution for individuals and businesses alike.

.

💬 Let’s discuss!

I’m online in Telegram and Discord to discuss your project: